1. Introduction: A High-Efficiency Decision Tool for Professionals

In today’s compact equipment market, the efficiency and versatility of mini skid steer loaders (stand-on/track models) have become key to determining project profitability. This guide is designed for experienced contractors and equipment dealers, aiming to help you make optimal equipment investment or inventory decisions through in-depth data analysis of key performance indicators and mainstream market brands.

Key Points Preview:

- 5 core technical indicators for professional selection.

- Quick overview table of key data for 11 mainstream brands in the market.

- In-depth analysis of each brand’s history, technological advantages, and flagship models.

- Final recommendations for different operational needs.

2. 5 Core Technical Indicators for Professional Selection

1. Performance and Productivity:

- Rated Operating Capacity (ROC) and Tipping Load: Determines the equipment’s actual operational capability.

- Hydraulic System (GPM & PSI): Standard flow vs. high-flow options and their decisive impact on attachment performance (e.g., driving planers, trenchers).

- Lift Path: Vertical lift vs. radial lift advantages, disadvantages, and applicable scenarios.

2. Powertrain and Chassis:

- Engine: Brands (e.g., Kubota, Yanmar, Kohler), horsepower, torque curve, and Tier 4 Final emission standard compliance.

- Travel System: Tracked vs. wheeled. Focus on track width, ground clearance, and ground pressure (PSI), and their impact on different surfaces (lawns, mud).

3. Operator Station and Control System:

- Platform Design: Comfort of suspended platforms for operator efficiency during long hours.

- Control Mode: Joystick vs. dual-lever, and responsiveness and adjustability.

- Visibility and Safety: How the machine’s design affects visibility of the work area and attachments.

4. Maintenance Convenience and Total Cost of Ownership (TCO):

- Design: Accessibility of engine hood, hydraulic lines, and daily checkpoints.

- Parts Versatility and Dealer Network: Ability to quickly obtain wear parts and professional support.

- Resale Value: Brand reputation’s impact on equipment’s secondary market value.

5. Attachment Compatibility:

- Quick-Change Interface: Importance of universal interfaces (Common Industry Interface – CII).

- OEM Attachment Ecosystem: Variety of high-performance attachments provided by the brand.

3. 2025 Key Mini Skid Steer Loader Brands Quick Overview in Switzerland

| Brand | Representative Model | ROC (lbs) | Engine HP | Std Hydraulic Flow (GPM) | Estimated Price Range | Core Advantage |

|---|---|---|---|---|---|---|

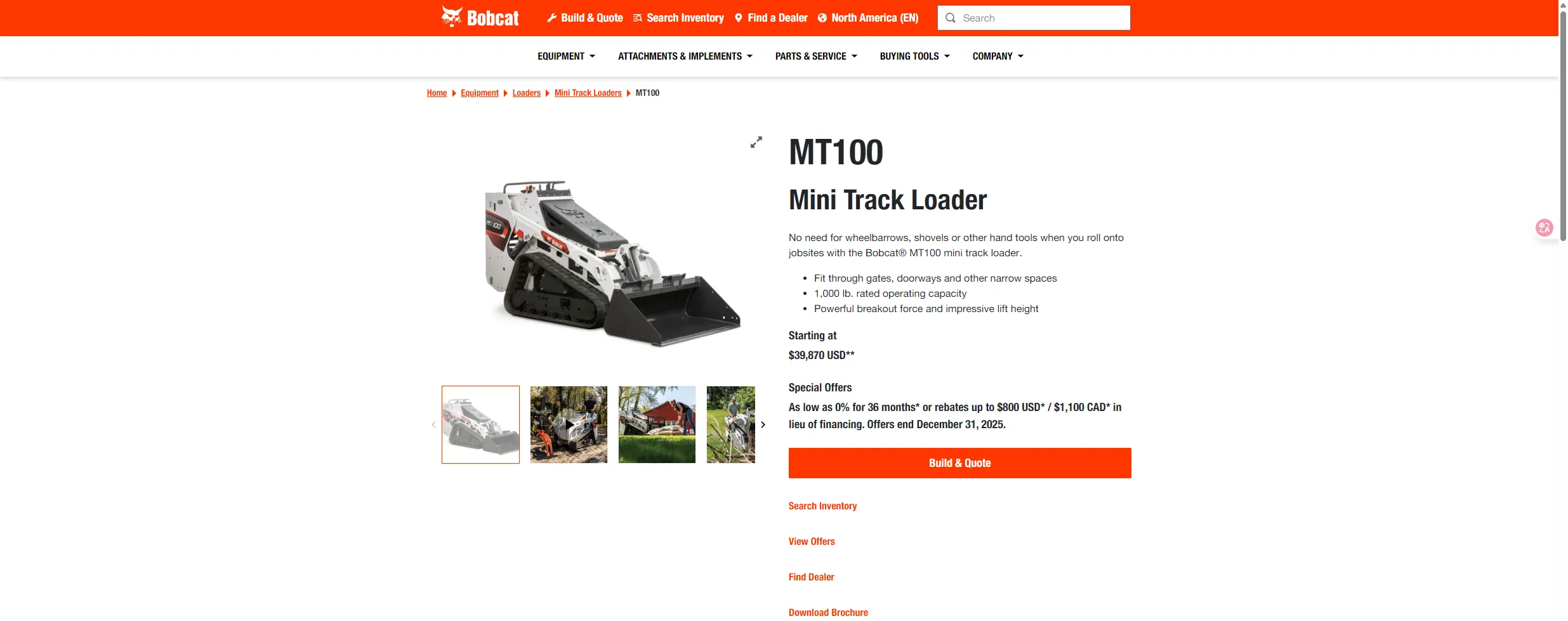

| Bobcat | MT100 | 1,000 | 24.8 | 12.0 | $35k – $45k | Market leader, vertical lift, user-friendly |

| Kubota | SSV65 | 1,950 | 64.0 | 18.0 | $50k – $60k | Engine reliability, low center of gravity design |

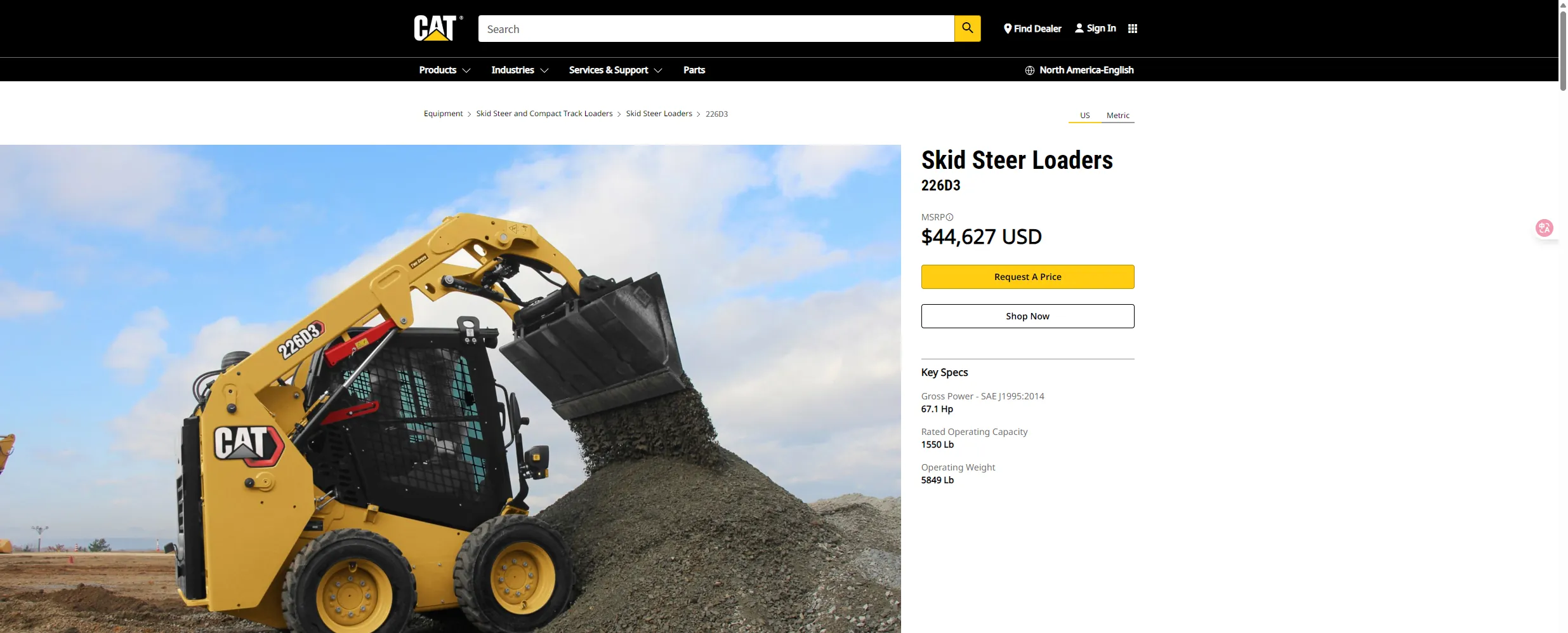

| Caterpillar | 226D3 | 1,550 | 67.1 | 18.0 | $40k – $60k | Brand reputation, attachment compatibility |

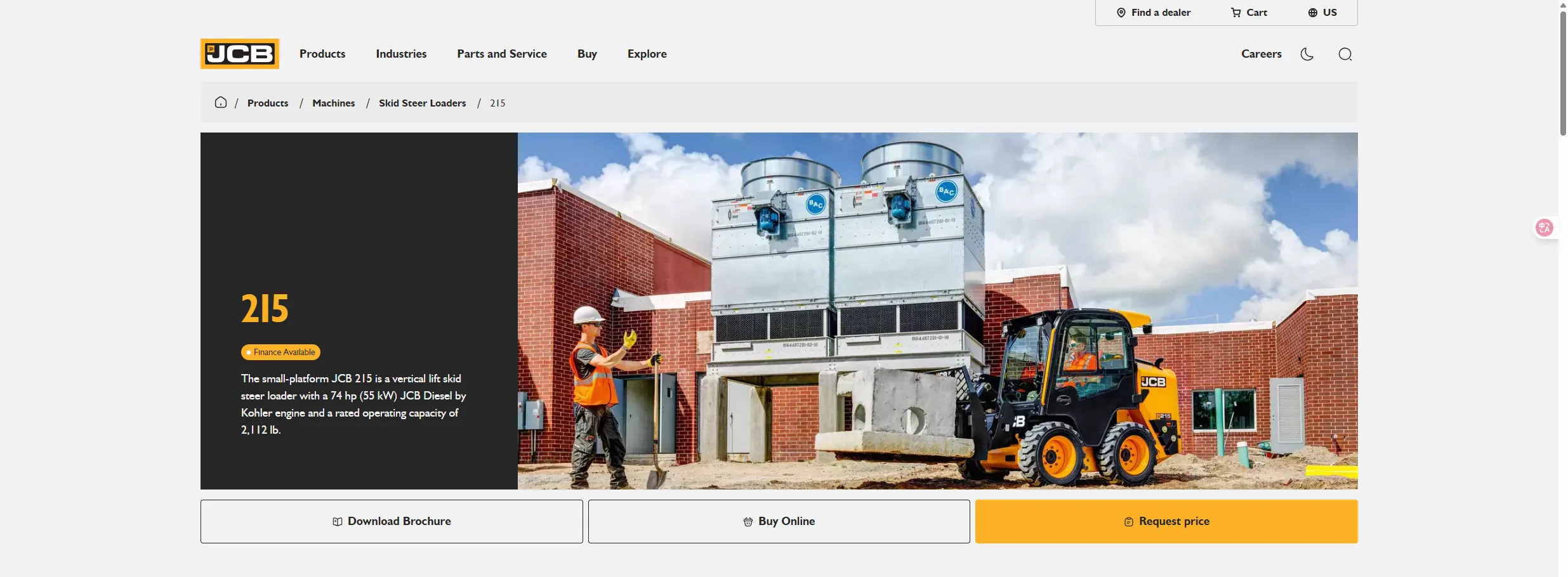

| JCB | 215 | 2,112 | 74.0 | 18.5 | $50k – $60k | Powerboom design, superior visibility |

| Gehl | R105 | 1,050 | 35.7 | 14.0 | Request quote | Cost-effective, self-leveling lift arms |

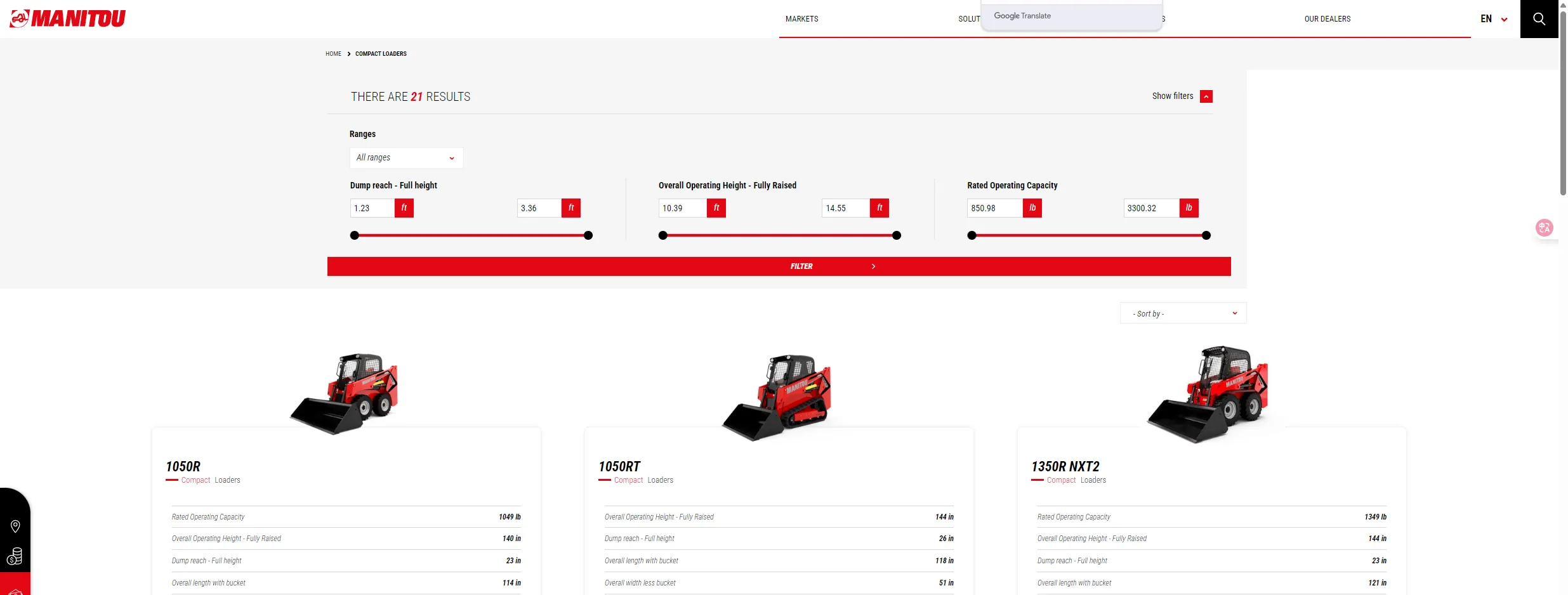

| Manitou | 1050R | 1,049 | 35.7 | 14.5 | Request quote | Load capacity, heavy-duty operations |

| Komatsu | SK715 | 1,543 | 47.0 | 15.9 | Request quote | Low fuel consumption, digging force |

| Vermeer | CTX160 | 1,600 | 40.0 | 16.0 | Request quote | Platform comfort, dual hydraulic circuits |

| Toro | Dingo TX 1000 | 1,000 | 24.8 | 13.7 | $35k – $45k | TX control system, extensive attachments |

| Wacker Neuson | SW16 | 1,600 | 56.0 | 20.0 | Request quote | Vertical lift path, eco-friendly options |

| DIG-BOY | DSL20 | 440 | 23.0 | 14.0 | $20k – $30k | Cost-effective, customizable configurations |

Disclaimer: The above data and prices are for reference only; please refer to dealer final quotes.

4. In-Depth Review of Mainstream Brands (Top 10)

1. Bobcat

- Company Background: Bobcat, originating in 1962, is a pioneer in compact loaders and invented the skid steer category. Now part of Doosan Bobcat, it leads in compact equipment innovation.

- Technology and Innovation:

- Patented Technologies: Sealed rollers for durability, Common Industry Interface (CII) for attachment compatibility, and SMART technology for attachment recognition and grade assist.

- Vertical Lift Arm Design: Provides higher loading height and greater stability in flagship models.

- Extensive Attachment Series: Offers over 35 OEM attachments, covering digging to material handling needs.

- Market Position and Customer Base: Dominates among landscape contractors, rental companies, and municipal departments. Its strong brand and dealer network ensure premium service and parts support.

- Representative Model Analysis (MT100):

- Key Metrics: 1,000 lbs ROC, over 80.9 inches dump height, ideal for loading trucks and hoppers.

- Applicable Scenarios: Landscape renovation, irrigation system installation, nursery operations requiring high mobility and versatility.

2. Kubota

- Company Background: Kubota, founded in 1890 in Japan, is a specialist in agricultural and compact equipment, entering the skid steer market as a latecomer but leveraging engine expertise for reliable products.

- Technology and Innovation:

- Patented Technologies: Kubota Shockless Ride for operator comfort and multi-function levers for precise control.

- Vertical Lift Arm Design: Ensures stability and reach in various models.

- Extensive Attachment Series: Compatible with a wide range of attachments for agriculture and construction.

- Market Position and Customer Base: Targets agriculture, construction, landscaping, and rental companies. Strong presence in Switzerland through dealers like Ad. Bachmann AG.

- Representative Model Analysis (SSV65):

- Key Metrics: 1,950 lbs ROC, 118.5 inches hinge pin height, suitable for heavy loads.

- Applicable Scenarios: Farming, construction sites, and tasks needing reliability in tight spaces.

3. Caterpillar

- Company Background: Caterpillar, founded in 1925, is a global leader in construction equipment, extending expertise to compact lines as a specialist in heavy-duty applications.

- Technology and Innovation:

- Patented Technologies: SMART attachment recognition, grade assist, and Product Link for monitoring.

- Lift Design: Offers both vertical and radial options for versatility.

- Extensive Attachment Series: Broad ecosystem for construction attachments.

- Market Position and Customer Base: Focuses on construction, rental, and landscape contractors. Available in Switzerland via Avesco AG.

- Representative Model Analysis (226D3):

- Key Metrics: 1,550 lbs ROC, 124.9 inches hinge pin height, high visibility.

- Applicable Scenarios: Urban construction, material handling in confined areas.

4. JCB

- Company Background: JCB, founded in 1945 in the UK, is a specialist in construction equipment, with a strong position in compact loaders through innovative designs like the Powerboom.

- Technology and Innovation:

- Patented Technologies: Powerboom single-arm design for better visibility and Smoothride System for load retention.

- Lift Design: Enhanced reach and stability.

- Extensive Attachment Series: Wide range for agriculture and construction.

- Market Position and Customer Base: Targets construction, agriculture, and rental companies. European presence supports Swiss market.

- Representative Model Analysis (215):

- Key Metrics: 2,112 lbs ROC, 121 inches hinge pin height, powerful engine.

- Applicable Scenarios: Heavy-duty tasks in agriculture and building sites.

5. Gehl

- Company Background: Gehl, founded in 1859, is a specialist in compact equipment, with a long history in agriculture extending to mini skid steers.

- Technology and Innovation:

- Patented Technologies: Power-A-Tach for quick attachments and IdealTrax for track tensioning.

- Lift Design: Radial or vertical lift options.

- Extensive Attachment Series: Versatile for multiple applications.

- Market Position and Customer Base: Agriculture, construction, and landscaping. Available through European dealers.

- Representative Model Analysis (R105):

- Key Metrics: 1,050 lbs ROC, 115 inches hinge pin height, compact design.

- Applicable Scenarios: Tight spaces in landscaping and farming.

6. Manitou

- Company Background: Manitou, founded in 1958 in France, is a specialist in handling equipment, offering compact skid steers as part of its broad portfolio.

- Technology and Innovation:

- Patented Technologies: JSM joystick for intuitive control and regenerative hydraulics for efficiency.

- Lift Design: High reach for loading.

- Extensive Attachment Series: Multi-functional attachments.

- Market Position and Customer Base: Construction, agriculture, and industrial users. Strong European network.

- Representative Model Analysis (1050R):

- Key Metrics: 1,049 lbs ROC, 140 inches hinge pin height, all-terrain.

- Applicable Scenarios: Industrial handling and construction.

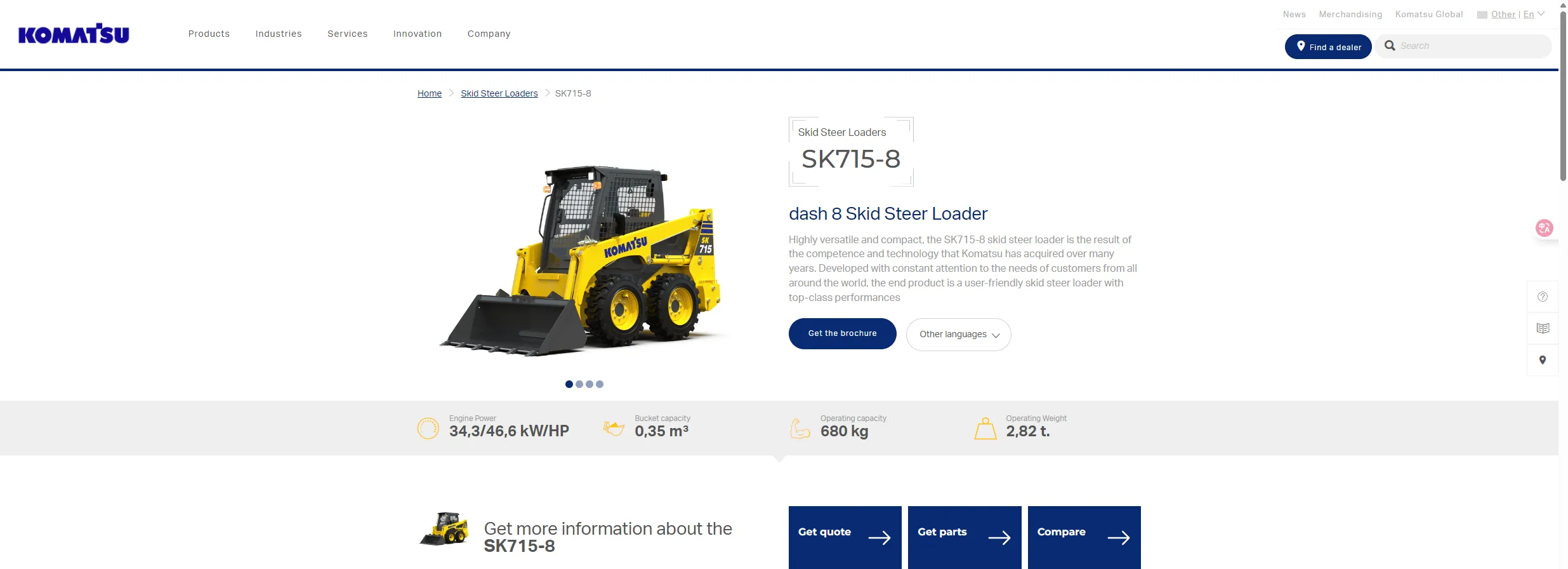

7. Komatsu

- Company Background: Komatsu, founded in 1921 in Japan, is a latecomer to compact skid steers but leverages heavy equipment expertise for efficient models.

- Technology and Innovation:

- Patented Technologies: Low fuel consumption systems and strong digging force.

- Lift Design: Balanced for productivity.

- Extensive Attachment Series: Compatible with construction tools.

- Market Position and Customer Base: Construction and rental companies. Global presence includes Europe.

- Representative Model Analysis (SK715):

- Key Metrics: 1,543 lbs ROC, 118 inches hinge pin height, efficient travel.

- Applicable Scenarios: Site preparation and utility work.

8. Vermeer

- Company Background: Vermeer, founded in 1948 in the US, is a specialist in utility and landscaping equipment, with a focus on mini skid steers for tight jobsites.

- Technology and Innovation:

- Patented Technologies: Cab suspension system for comfort and universal mounting plate.

- Lift Design: Heavy lift in compact footprint.

- Extensive Attachment Series: Variety for landscaping.

- Market Position and Customer Base: Landscaping contractors, construction, tree care. Available in Europe.

- Representative Model Analysis (CTX160):

- Key Metrics: 1,600 lbs ROC, 84 inches hinge pin height, low ground pressure.

- Applicable Scenarios: Tree care and soft terrain work.

9. Toro

- Company Background: Toro, founded in 1914, is a specialist in turf and landscape equipment, pioneering stand-on mini loaders like the Dingo series.

- Technology and Innovation:

- Patented Technologies: TX control system for intuitive operation and IntelliFloat for ground following.

- Lift Design: Stand-on platform for visibility.

- Extensive Attachment Series: Over 35 options for landscapes.

- Market Position and Customer Base: Landscape contractors and rental companies. Strong global dealers.

- Representative Model Analysis (Dingo TX 1000):

- Key Metrics: 1,000 lbs ROC, 81 inches hinge pin height, compact size.

- Applicable Scenarios: Tight space landscaping and maintenance.

10. Wacker Neuson

- Company Background: Wacker Neuson, founded in 1848 in Germany, is a specialist in light and compact equipment, with a focus on innovative compact loaders.

- Technology and Innovation:

- Patented Technologies: Vertical lift path for higher reach and electric options for eco-friendliness.

- Lift Design: Enhanced for urban use.

- Extensive Attachment Series: Broad for construction.

- Market Position and Customer Base: Construction, landscaping, rental. Strong in Europe, including Switzerland.

- Representative Model Analysis (SW16):

- Key Metrics: 1,600 lbs ROC, 122 inches hinge pin height, high flow option.

- Applicable Scenarios: Urban and environmental projects.

5. #11 – DIG-BOY: Leveraging Globalized Production as a Brand

11. DIG-BOY

- Company Positioning: DIG-BOY is a company headquartered with global strategies, establishing production bases in China to optimize manufacturing costs. Its product design, engineering standards, and quality control follow market requirements.

- Products and Business Model:

- Core Component Strategy: Equipment commonly uses industry-recognized third-party core components, such as Kubota engines and Bonfiglioli drive motors, ensuring reliability in power and transmission systems.

- Cost Advantage: By integrating global supply chains and optimizing production processes, DIG-BOY aims to provide products with significant price competitiveness, making it an attractive option for cost-sensitive contractors and dealers.

- Market Analysis: For professional buyers who value initial return on investment, do not pursue specific brand premiums, but have clear requirements for core hardware like engines, DIG-BOY offers a value proposition worth examining. Its model tests the company’s service response and parts support capabilities.

6. Conclusion and Purchase Recommendations

- Market Summary: Summarizes current trends in the mini skid steer market, such as electrification and remote control.

- Final Recommendations:

- For dealers and large contractors pursuing top brands and widest support networks: Bobcat, Kubota, Caterpillar, and JCB are top choices.

- For specific applications (e.g., agriculture, forestry): Kubota’s reliability and Vermeer’s low ground pressure stand out.

- For buyers seeking to maximize capital efficiency and focus on core hardware performance: Include DIG-BOY in the evaluation scope and conduct detailed due diligence on its specifications, pricing, and local service support.